how to calculate nj taxable wages

Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. The NJ Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for.

Like most US States both New York and New Jersey require that you pay State income taxes.

. The New Jersey Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and New Jersey. Taxable Retirement Income. You must report all payments whether in cash benefits or.

You must report all payments whether in. Your average tax rate is 1198 and your marginal tax. Your employer uses the information that you provided on your W-4 form to.

New Jersey Income Tax Calculator 2021 If you make 70000 a year living in. Under the FLSA these. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34.

So the tax year 2022 will start from July 01 2021 to June 30 2022. However if you do not have withholdings or enough withholdings taken out of a paycheck you may have to make estimated payments. The state income tax rate in New Jersey is progressive and ranges from 14 to 1075 while federal income tax rates range from 10 to 37 depending on your income.

Just enter the wages tax withholdings and other information required. The actual amount of tax taken from an employees paycheck is also dependent on their filing status single or married and number of allowances both of which are reported. Calculating your New Jersey state income tax is similar to the steps we listed on our Federal paycheck.

In short youll have to file your taxes in both states if you live in NJ and work in NY. The New Jersey income tax calculator is designed to provide a salary example with salary deductions made in New. The New Jersey tax calculator is updated for the 202223 tax year.

Wages include salaries tips fees commissions bonuses and any other payments you receive for services you perform as an employee. If you estimate that you will owe more than 400 in. Under the new legislation New Jerseys.

Federal income taxes are also withheld from each of your paychecks. After the wage cap is met salary deductions. The New Jersey tax calculator is updated for the 202223 tax year.

Rates for board and room meals and lodging under the New Jersey Wage and Hour laws or regulations may be found at NJAC. How Your New Jersey Paycheck Works. Taxable pensions include all state and local government teachers and federal pensions as well as employee pensions and annuities from.

New Jersey Income Tax Calculator Calculate your federal New Jersey income taxes Updated for 2022 tax year on Aug 31 2022 What was updated. Round down if less than 0005. Calculate your take home pay after federal new jersey taxes deductions and exemptions.

The states SUTA wage base is 7000 per. 1256-8 1256-13 and 1256-14. If you make 70000 a year living in the region of New Jersey USA you will be taxed 12783.

New Jersey Income Tax Calculator 2021.

Live And Work In Indiana But Paid Out Of Nj

Individual Income Taxes Urban Institute

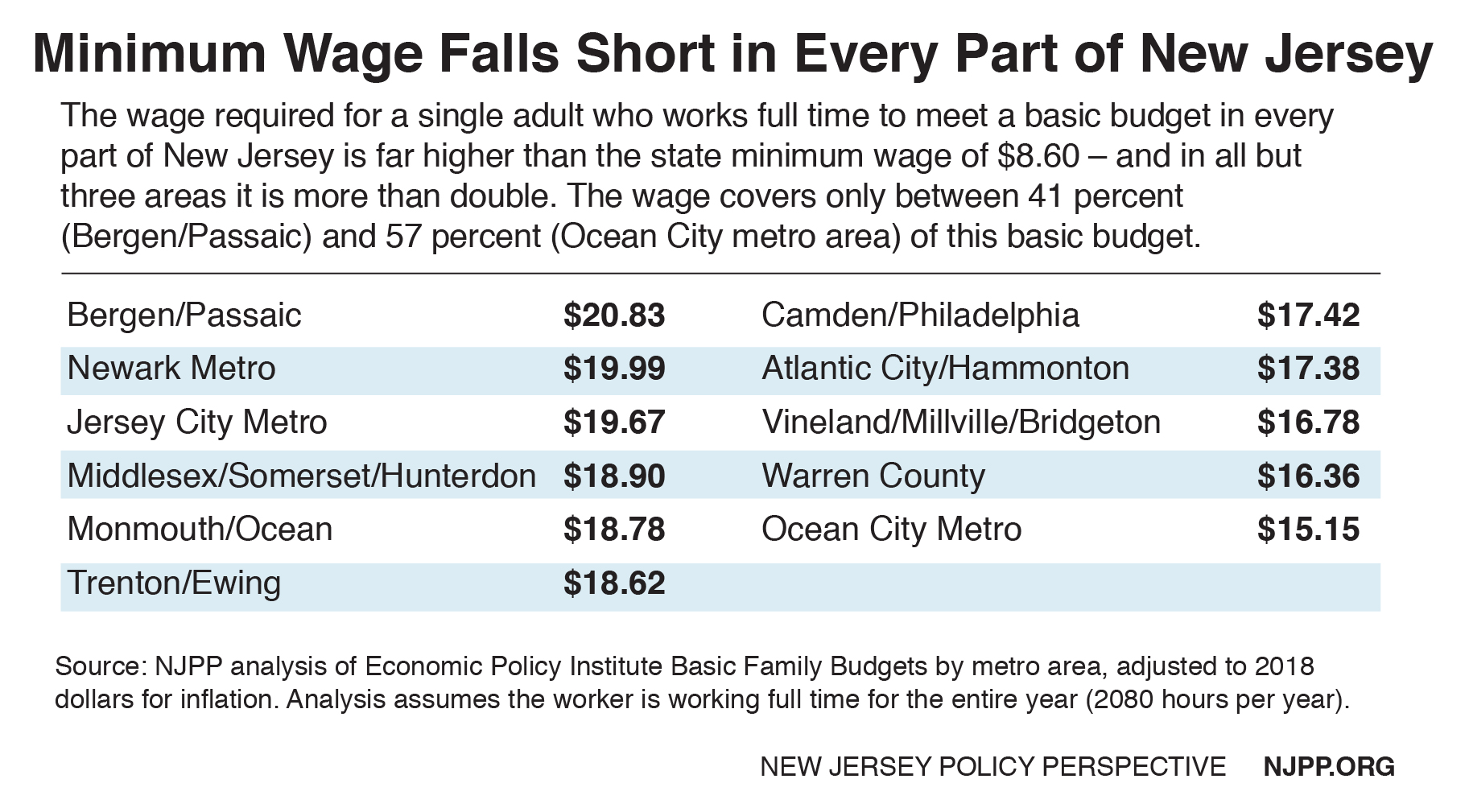

A 15 Minimum Wage Would Help Over 1 Million Workers And Boost New Jersey S Economy New Jersey Policy Perspective

How Do State And Local Individual Income Taxes Work Tax Policy Center

New Jersey State Taxes 2021 Income And Sales Tax Rates Bankrate

Nj Temporary Disability Insurance Rates For 2022 Shelterpoint

2022 Federal State Payroll Tax Rates For Employers

Department Of Labor And Workforce Development Nj Labor Dept Max Benefit Rates Increase On Jan 1

Aatrix Nj Wage And Tax Formats

State Income Tax Rates Highest Lowest 2021 Changes

Nj Temporary Disability Insurance Rates For 2022 Shelterpoint

Prepare E File 2021 New Jersey Income Tax Returns Due In 2022

Nj Property Taxes Have Been Rising At A Slower Pace Nj Spotlight News

New Jersey Salary Calculator 2022 Icalculator

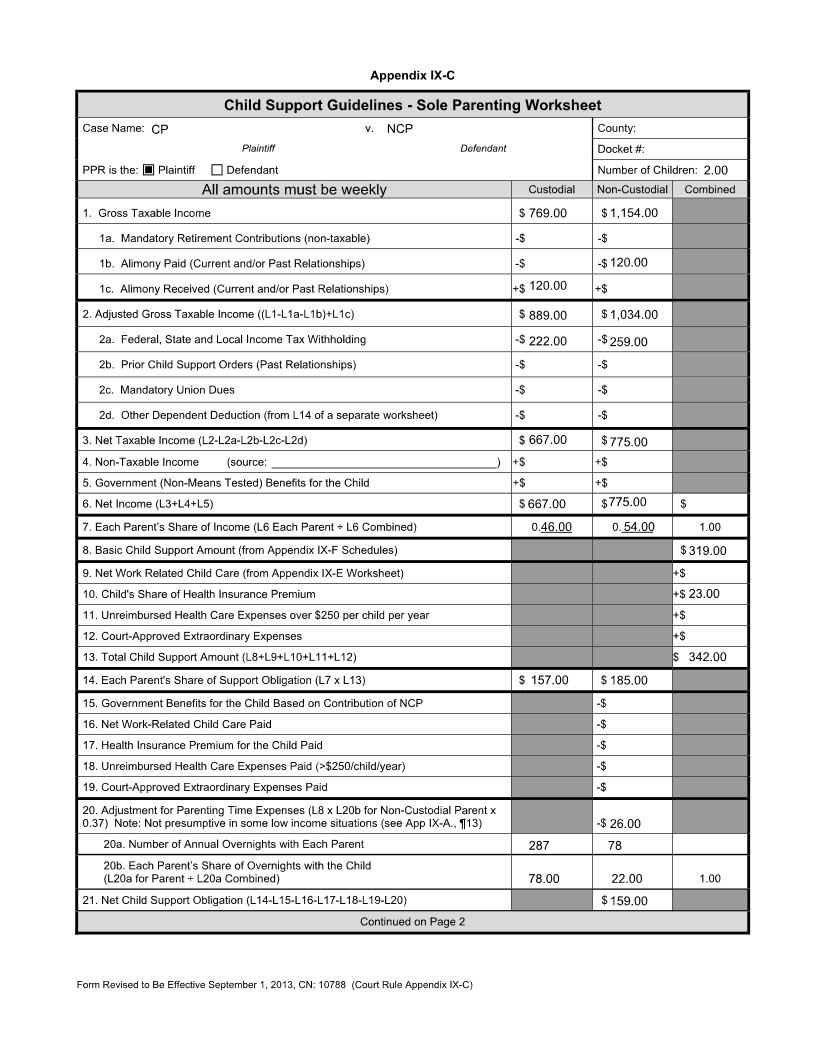

How Much Child Support Will I Pay In New Jersey

Understanding W 2 Box 1 Federally Taxable Wages Tips And Other Compensation Line 7 On 1040 Box 2 Federal Income Tax Withheld Line 64 On 1040 Box Ppt Download

Surviving Off A 400k Income Joe Biden Deems Rich For Higher Taxes